The rapid growth phase of the European Union’s solar market has begun to slow, marking a turning point after several years of strong expansion. In 2025, new solar installations in the EU declined slightly to 65.1 gigawatts, down from 65.6 gigawatts in 2024. This 0.7% contraction makes 2025 the first year since 2016 in which the EU installed less solar capacity than the previous year, signaling the end of the boom years seen throughout the early 2020s.

Despite this slowdown, the year also delivered an important milestone. Under the EU Solar Strategy launched in 2022, the bloc set a target of reaching 400 gigawatts of total installed solar capacity by 2025. This goal has been achieved, with total solar capacity across the EU estimated to reach around 406 gigawatts by the end of the year. While this achievement reflects the strength of earlier growth, it also highlights the growing challenge of maintaining momentum going forward.

According to Walburga Hemetsberger, Chief Executive Officer of SolarPower Europe, the decline in annual installations may appear small in numerical terms, but it carries strong symbolic meaning. While the EU has successfully met its 2025 solar target, progress toward the 2030 goal is now at risk. This slowdown comes at a critical time, as solar energy is playing an increasingly important role in Europe’s power system. In 2025, solar accounted for 13% of the EU’s electricity generation, and in June it was the single largest source of power across the bloc. She emphasized that policymakers now need to act decisively by strengthening frameworks for electrification, improving system flexibility, and expanding energy storage to ensure solar continues to lead Europe’s energy transition throughout the rest of the decade.

Several factors are contributing to the weakening market. Following the energy crisis, uncertainty has increased, and many countries have reduced or withdrawn support schemes for rooftop solar. At the same time, energy price pressures on households have eased, reducing the urgency for homeowners to invest in solar systems. As a result, the residential rooftop segment has slowed sharply. While home solar installations accounted for 28% of total EU capacity additions in 2023, their share fell to just 14% in 2025.

In contrast, utility-scale solar projects have continued to expand. For the first time, solar farms accounted for more than half of all newly installed solar capacity in the EU. However, this segment is also facing growing challenges. Standalone solar projects are increasingly affected by profitability pressures, particularly due to a rise in negative electricity pricing hours. These periods of oversupply reduce revenues and create uncertainty for investors, even as capacity continues to grow.

Across individual market segments, the situation is changing, but the overall ranking of leading solar countries remains largely stable. Germany and Spain continued to lead the EU in new solar installations in 2025, driven mainly by large-scale utility projects as rooftop incentives declined. France moved into third place, overtaking Italy, supported by strong growth in commercial and utility-scale installations. Italy, by contrast, saw a sharp contraction in its rooftop market following the phase-out of key support measures.

There were also notable shifts among emerging markets. Romania and Bulgaria entered the EU’s top ten solar markets for the first time. Romania recorded the fastest growth rate among leading markets, while Bulgaria’s expansion was closely linked to national recovery funding deadlines. Meanwhile, the Netherlands dropped to eighth place, reflecting a significant slowdown in rooftop installations. Overall, half of the top ten EU solar markets installed less solar capacity in 2025 than in 2024, including Italy, Poland, Greece, the Netherlands, and Portugal.

From WOCHN perspective, several trends are becoming increasingly clear:

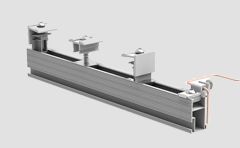

Utility-scale and commercial projects will remain the primary growth drivers, requiring mounting systems that are faster to install, structurally reliable, and adaptable to diverse site conditions.

As grid congestion and negative pricing become more frequent, projects with optimized layouts, improved ventilation, and better long-term performance will gain a competitive advantage.

The contraction of the residential rooftop segment highlights the importance of simplified installation and reduced labor dependency, especially as installers face cost pressure and workforce constraints.

Looking ahead, we’re excited to continue these conversations in person at GREEN ENERGY EXPO & ROMENVIROTEC 2026 in Bucharest, where we will showcase practical solutions for utility-scale, commercial, and rooftop projects. It will be a great opportunity to exchange insights, explore innovations.