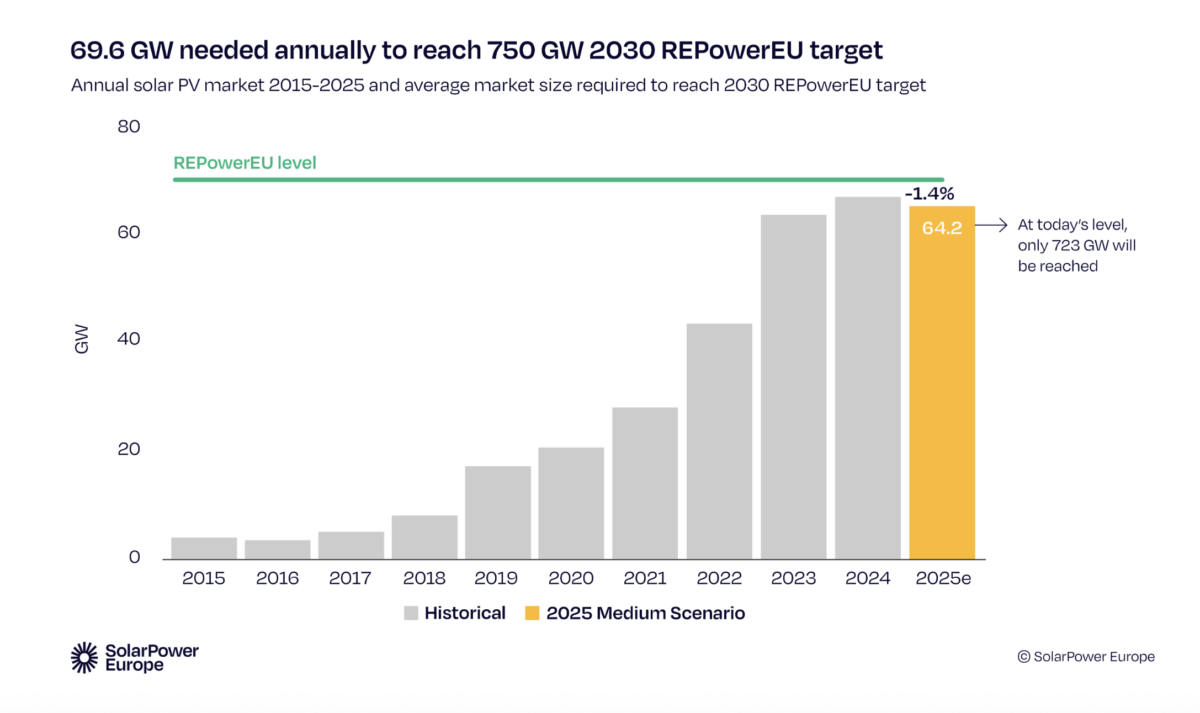

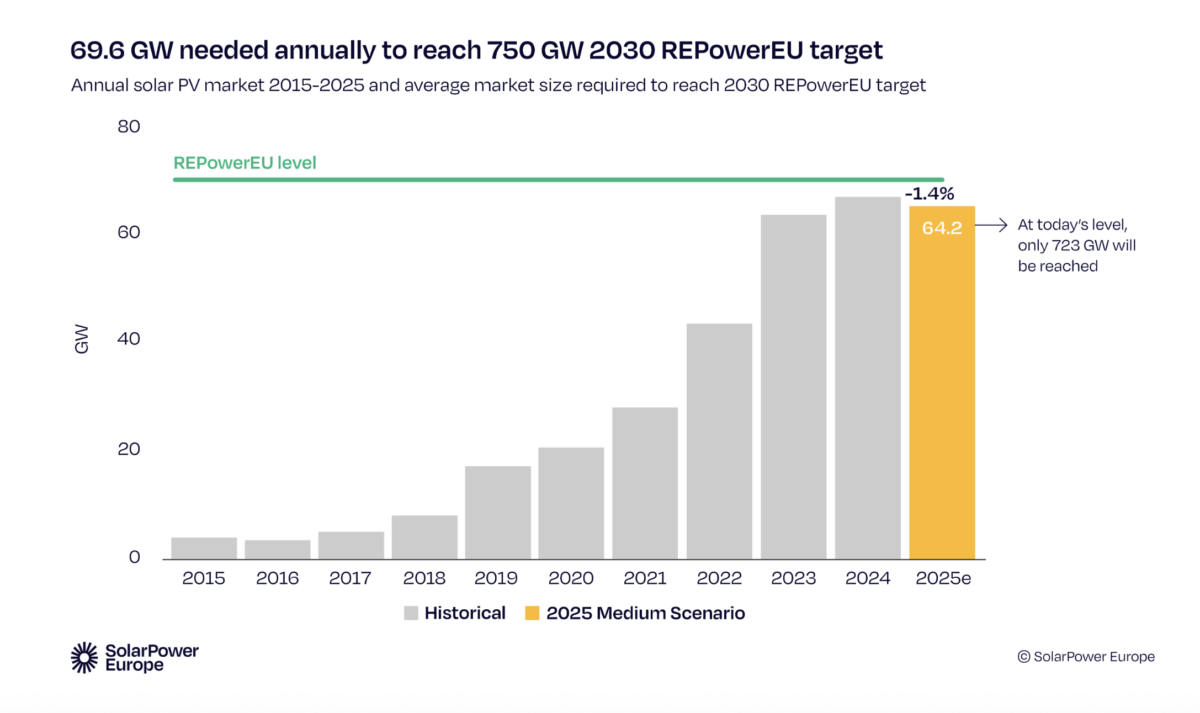

According to the latest report from SolarPower Europe (SPE), "EU Market Outlook for Solar Power: 2025 Mid-Year Analysis", the EU photovoltaic market will see its first annual installation decline since 2015 in 2025, with new installations expected to be 64.2GW, a decrease of 1.4% from 65.1GW in 2024.

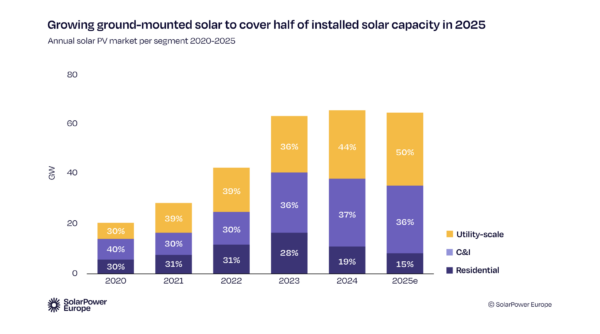

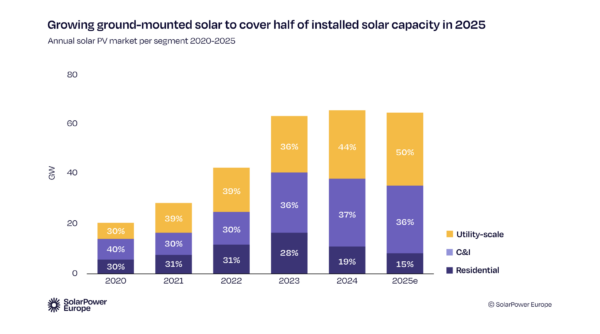

Ground-mounted photovoltaic installations grew strongly, but were unable to offset the decline in the residential market.

The report analyzes that this year's decline in installed capacity is primarily due to a slowdown in the residential rooftop PV market. Even in traditionally strong markets such as the Netherlands, Austria, the Czech Republic, and Hungary, residential PV projects are widely delayed. SPE cites two key factors contributing to the market decline: the continued decline in electricity prices following the 2022 energy crisis and the failure to introduce effective alternatives in a timely manner after the withdrawal of incentive policies in many countries. New residential PV installations in markets such as Poland, Spain, and Germany have all declined by over 40%.

CPPA were once a key driver of large-scale ground-mounted power plants in Europe, but with electricity prices continuing to decline in 2025, buyers' interest in long-term power purchase contracts has significantly waned. According to statistics, after reaching a record 7GW in corporate power purchase agreement contracts in 2024, the market began to decline in 2025, with contract volumes plummeting 41% in the second quarter compared to the first. Although the cumulative total of CPPA contracts has exceeded 20GW, SPE emphasizes that the future recovery of the market still depends on the continued strengthening of the policy framework.

Despite a decline in PPA signings, ground-mounted PV installations continue to grow strongly, accounting for nearly half of all new capacity added in the EU through 2025. This trend is driven by EU member states' reforms to optimize auction design. In 2024, the EU set a new record for winning auctions for 20 GW of ground-mounted PV projects, with Germany, the Netherlands, France, and Italy taking the top four spots.

]

The 2025 target is nearly reached, but long-term goals remain to be met

Despite short-term market fluctuations, the EU is on track to achieve its 2025 PV installation targets of 400 GW (DC) and 320 GW (AC) as planned, thanks to continued growth in 2022 (+47%), 2023 (+51%), and 2024 (+3.3%). By the end of 2025, EU PV installed capacity is projected to reach 402 GW (DC).

However, at the current rate of development, the strategic goal of 750 GW (DC) / 600 GW (AC) by 2030 will be difficult to achieve. SPE predicts that by the end of 2030, the EU's cumulative installed capacity will be only 723 GW (DC). To meet the target, the EU must maintain an annual installed capacity of 69.6 GW.

SPE calls for increased policy support to promote energy storage and power system flexibility

Dries Acke, Deputy CEO of SPE, said: "Although the decline (in 2025) is small, its symbolic significance is significant. The market downturn at a time when photovoltaics should be accelerating should attract the attention of EU leaders. Europe needs competitive electricity prices, energy security and climate solutions, and photovoltaics can meet these needs at the same time.

Michael Schmela, head of market intelligence at SPE Executive Advisors, added: “To continue Europe’s PV success story and achieve its 2030 renewable energy targets, the most critical solution is clear – a rapid expansion of energy storage to enhance overall power system flexibility.”

As a member of WOCHN New Energy, the decline in EU PV installations by 2025 (particularly the shrinking residential market) is a real wake-up call. While strong demand for ground-mounted solar panels is positive for our ground-mounted mounting business, the overall slowdown in growth highlights the industry's urgent need for a stable policy and market environment. The report further warns that if annual capacity additions fail to exceed 70GW, the EU's 2030 targets will be in jeopardy. Policy support and technological innovation are both essential, and we must keep pace with trends to prepare for future high growth.