The 2025 Intersolar Europe was held from May 6 to 9, local time. Due to reflections on the Spanish power outage, the discussion on solar + energy storage remained hot this year.

Market trends and policy background

According to this field survey, the demand in Europe this year may be reduced compared with last year, with major countries supporting the market from France, Italy, Austria, Romania, etc., maintaining stability and increasing slightly. The demand in some countries, such as Spain and Greece, is affected by factors such as the decline in electricity prices, which affects the benefits of distributed projects, and the extension of policy grid connection time. This year's demand may show a slight downward trend, and the market generally discusses that the installed AC side will fall to the level of 65-70 GW.

The countries with the most discussion are:

A massive blackout hits Spain

The impact of the power outage has caused the market to rethink the stability of the long-term energy structure. Although the impact is not obvious in the short term, the current demand is still affected by the incentive of storage subsidies. There are still many projects planned to be concentrated in the first half of 2026, so the short-term impact is relatively small. However, this incident has given the country a mirror to reflect on. Many people are discussing whether the long-term energy structure will be adjusted. The long-term demand development is currently pessimistic.

Germany

The "Photovoltaic Peak Law" policy implemented at the end of February this year has strengthened the management of photovoltaic projects that have grown rapidly in recent years, and stipulates that for new projects with a capacity of more than 2 kW, EEG subsidies will be suspended during periods of negative electricity prices.Data from Bundesnetzagentur also shows the impact of the policy. Germany added approximately 0.79 GW of photovoltaic installed capacity in March 2025, a decrease of 53% from 1.67 GWac in February and a decrease of 44% from 1.4 GWac in March 2024.

Technology and Exhibits Highlights

Non-standard components also received a lot of attention in this discussion. Under homogeneous competition, some manufacturers launched products of different specifications to adapt to the scene types. Applications cover emerging scenes such as agricultural photovoltaics, fence photovoltaics, balcony photovoltaics and even BIPV.

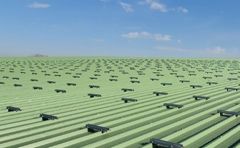

In agricultural photovoltaic systems, modules not only provide power, but also have added value such as shading, frost protection and drought relief, which helps to increase crop yields.

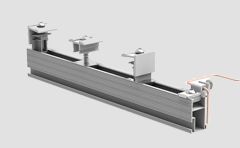

When global module production capacity is oversupplied and prices are falling, the European market has also begun to explore new business opportunities for fence-type photovoltaics. This type of system is designed to be installed vertically, which not only prolongs the sunshine time, but also creates peak power generation in the morning and evening.

Balcony photovoltaics and products that focus on aesthetics are also developing rapidly, and solutions for combining them with energy storage have also been discussed recently.

Summarize

The discussion heat of the European exhibition this year is the same as last year. The hot topics still revolve around: changes in demand and overall price trends. The subsequent discussion focuses on when the supply chain will rebound?

The first issue that we are concerned about in the short term is the recent decline in supply chain prices. During the exhibition, component prices have shown a clear downward trend. The current delivery is generally at the level of $0.09-0.095 per watt DDP, among which the project price level is slightly higher, while the spot price is less than $0.09 per watt, and most of them are at the level of $0.085-0.088. Non-mainstream wattage deliveries are at the price level of $0.067-0.08 per watt. There are differences in market prices. A new round of negotiations will be launched after the exhibition.